I got a letter from the IRS – Now What?

The IRS has dozens of letters and notices. Depending on which you receive action may need to be taken. Let’s talk about the common notices you may see.

February 26, 2022 | 4 Min Read

In this article we will discuss:

Locating your Notice or Letter number

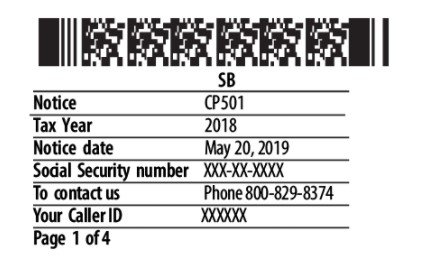

Notices generally start with a “CP” followed by a number. These can be found in a box at the top right corner of the notice. Letters will have an “LT” followed by a number located in the bottom right-hand corner of the first page.

CP14 – Balance Due Notice

The CP14 is often the first notice in the collection process. It means that the IRS has processed your return and you still have tax due. It lets you know the amount of tax, including interest and penalties to date. Additionally, it requests payment within 21 days.

CP501 – 1st Notice (Important) – Balance Due

This is the second notice in the collection process and your first reminder that you have tax due.

CP503 – 2nd Notice (Urgent) – Balance Due

This is the third notice in the collection process and your second reminder that you have tax due. Time is starting to run out before collection action is taken by the IRS.

CP504 – Final Notice — Balance Due

You received this notice because you have not responded to the previous notices of tax due. This notice also serves as a Notice of Intent to Levy on any state tax refunds going forward. A state tax refund levy would mean the IRS will seize refunds directly from the state to help recover the amount that you owe. This also is a formal warning that the IRS is prepared to issue a Final Notice of Intent to Levy. This serves as one of the last warnings before the IRS aggressively takes funds from bank accounts, garnishes wages or collects directly from customers of self-employed individuals.

LT1058, CP90 or LT11 – Final Notice of Intent to Levy

These are letters that should never be ignored! This is your Final Notice of Intent to Levy. The IRS has not heard from you and has not received payment for overdue taxes. The next step is a levy to your wages or bank accounts. The IRS can also file a Notice of Federal Tax Lien which means the government has a right to your interests in your current assets and any assets you acquire after they file the lien.

What’s at risk:

- Bank Accounts

- Wages

- Home or properties

- Passport

In order to stop the levy of these items and provide an alternative resolution to the matter, the IRS gives a 30-day window to contact them to resolve the balances or request an appeals hearing.

LT 3172 – Notice of Federal Tax Lien Filing

The LT3172 is a notice of Federal Tax Lien Filing (NFTL) and Your Right to a Hearing Under IRC 6320. Since you have a tax balance and have not responded to the notices the IRS has filed a Notice of Federal Tax Lien (NFTL), with the local and/or state authorities to alert creditors that the government has a right to your interests in any current and future property and assets. This is a public filing and is typically filled in the county that you reside.

LT531 or CP3219A – Notice of Deficiency

The LT531or CP3219A are called Notices of Deficiency. These letters show the proposed adjustments to your accounts. These are based upon the results of an audit or changes to your original return filing for amounts not shown on your return where the IRS has income records. These IRS letters and notices should not be ignored if you do not agree with the proposed changes. There is a 90-day window in which you may request the case be reviewed by tax court if you do not agree with the changes. This may be your only opportunity to dispute the matters in some cases.

Start Your Tax Relief Journey

You don’t need to do this on your own. Let the team at TaxpayerBillofRights.com help you find a qualified Certified Tax Resolution Specialist!

On a similar note…

I got a letter from the IRS – Now What?

I got a letter from the IRS – Now What?

IRS Fresh Start Program

IRS Fresh Start Program

Do I Need a Tax Attorney?

Do I Need a Tax Attorney?

Navigating the IRS on your own is a real challenge. Find a trustworthy practitioner to help with your tax problem.

We specialize in connecting taxpayers struggling with IRS issues and trusted tax professionals that can help them get back on track!

Our partnership with the American Society of Tax Problems Solvers (ASTPS) gives us access to the top tax resolution experts across the country. There is no way for a practitioner to buy their way in, they can only apply after they have met our rigorous requirements.

Click the button below to see if you qualify for tax relief and to start the tax resolution process right now! You have absolutely nothing to lose - this is a completely free service for taxpayers!

On a similar note...

I got a letter from the IRS – Now What?

I got a letter from the IRS – Now What?

IRS Fresh Start Program

IRS Fresh Start Program

Do I Need a Tax Attorney?

Do I Need a Tax Attorney?

You don't have to do this on your own.

We've worked hard to create a network of the best IRS tax relief experts in the country! Each one has been fully vetted and have met our rigorous experience, education, and training standards.

Your first step to IRS tax relief is to click the button below and fill out our tax relief evaluation. After you finish you will be able to set up a 100% free consultation with a licensed tax pro in our network. You have absolutely nothing to lose, and worst case you'll gain insight into your options!